Advertisement

Purchasing a home will most likely be the biggest investment decision you make, and one that comes with specific financial obligations – but also enormous advantages. When you appreciate the benefits of home ownership, you will no longer see obligations such as repaying your loan or maintaining your home as a burden, but as a route to investing in your and your family’s future.

Financial benefits of home ownership

While there are many psychological and emotional advantages of home ownership, the financial advantages are possibly the most important. In fact, they probably contribute immensely to the others.

Some of these advantages are:

- In the medium to long term, costs related to home ownership will be lower than those of a rental unit.

- Your home’s value will in most instances grow over time.

- It provides independence and comfort for you and your family.

Let’s start by comparing the monthly payments related to two identical homes, both in the same area – one a rental property, the other a home purchased with a loan.

Advertisement

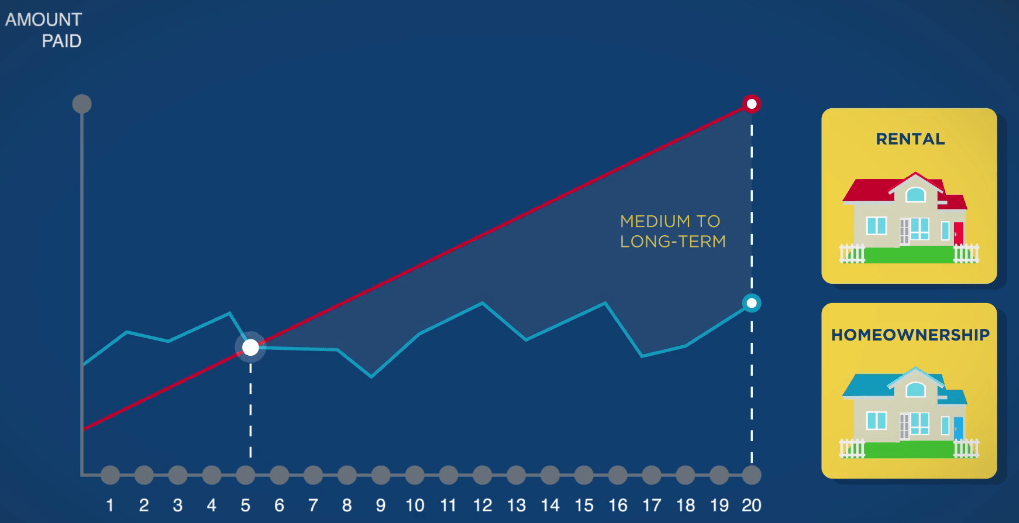

You are most likely aware that if you rent a property, the monthly rental will, as shown by the red line on the graph below, increase every year. The increases will often be in line with inflation for that period. The home loan instalment, as illustrated by the grey line, will in the beginning be greater than a rental payment, and will every now and again increase or decrease as interest rates go up or down. You will, however, notice that in the medium to long term you will generally be paying far less per month should you purchase a home instead of renting one.

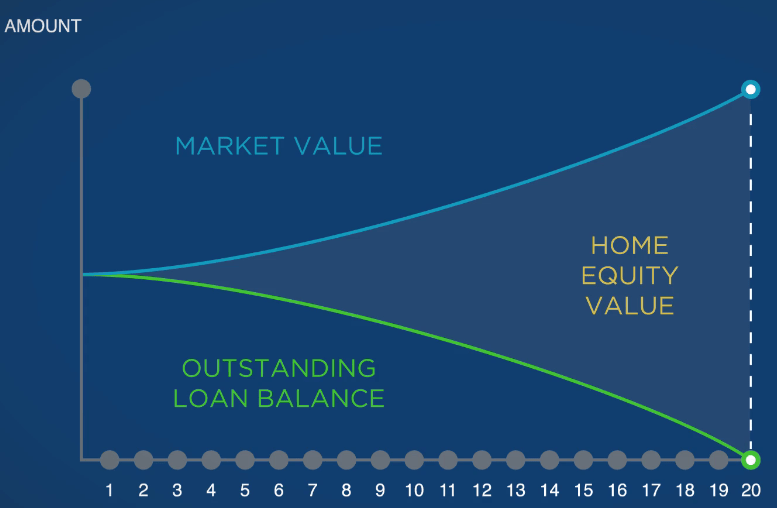

Another key financial benefit of owning your own home is that property prices and market values have on average shown an increase in the medium to long term, as shown in the graph below.

This example shows a typical increase in a home’s market value over time. The loan balance will, on the other hand, decrease every year as regular payments are made until it reaches zero at the end of the loan term. The difference between the market value and the outstanding loan balance is called home equity value. Should a home owner at any time decide to sell their home, they will be entitled to keep the difference between the market value and the outstanding loan balance. However, please note that you will usually have to pay sales commission from this amount.

Even if you are not planning to sell, lenders will more easily grant you a loan if you have home equity value. This could mean that you can take out an additional loan to fund your children’s education, or to fund other expenditure such as start-up costs for a small business.

Non-financial benefits of home ownership

While the financial benefits of owning your own home are quite obvious, there are other less tangible – but no less important – advantages:

- You can decorate and repaint your home in a style that suits you.

- Every rand that you spend on improvements benefits you, as it improves the value of your investment.

- Home ownership makes it easier to settle down in your community.

- There is a great feeling of permanence and involvement that comes with owning your own home.

- A home of your own also provides a place of comfort for you and your family, and gives you the flexibility to adapt your living space to your individual tastes and needs.

Now that you understand the significant benefits of home ownership, you will see that getting financially fit is not a burden, but rather the first step to financial wellbeing and peace of mind.

This is a very good advice

Good knowledge

Good to know how to own or rent a property