Advertisement

Careful planning for future repairs and replacements is in the best physical and fiscal interests of the community association. Maintaining a reserve fund not only meets legal, fiduciary and professional requirements, it also minimises the need for special levies, and enhances resale values. How does an association properly determine and compile adequate reserves to fund necessary repair and replacement costs? By conducting reserve studies.

Reserve studies

There are two components of a reserve study – a physical analysis and a financial analysis. During the physical analysis, a reserve provider evaluates information regarding the physical status and repair/replacement cost of the association’s major common area components.

A reserve study should include:

• a summary of the association, including the number of units/stands, physical description and the financial condition of the reserve fund

• a projection of the reserve starting balance, recommended reserve contributions, projected reserve expenses and the projected ending reserve fund balance for a minimum of 20 years

• an inventory with component quantity or identifying descriptions, useful life, remaining useful life and current replacement cost

• a description of the methods and objectives utilised in computing the fund status and in the development of the funding plan

• source(s) utilised to obtain component repair or replacement cost estimates

• a description of the level of service by which the reserve study was prepared and the fiscal year for which the reserve study was prepared.

In the interests of transparency and disclosure, experts recommend that a comprehensive reserve also includes:

• a statement disclosing other involvement(s) with the association that could result in actual or perceived conflicts of interest

• a narrative description of the physical analysis that details how the on-site observations were performed

• a description of the assumptions utilised for interest and inflation, tax

and other outside factors for the financial analysis

• a written explanation of the credentials held by the individual who prepared the reserve study

• a report on how the current work is reliant on the validity of prior reserve

studies

• discussion of material issues which, if not disclosed, would cause a distortion of the association’s situation

• reliable information provided by the association’s official representative

regarding financial, physical, quantity or historical issues.

The reserve study process consists of four stages, namely:

• determining a reserve schedule

• establishing a preventative maintenance schedule

• selecting a funding plan

• developing an investment policy

Advertisement

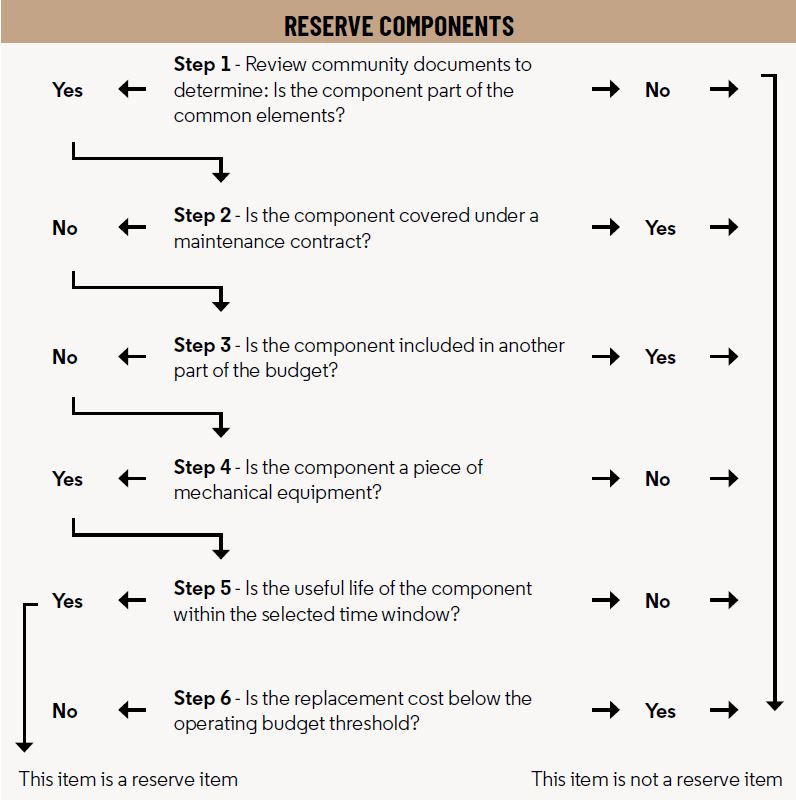

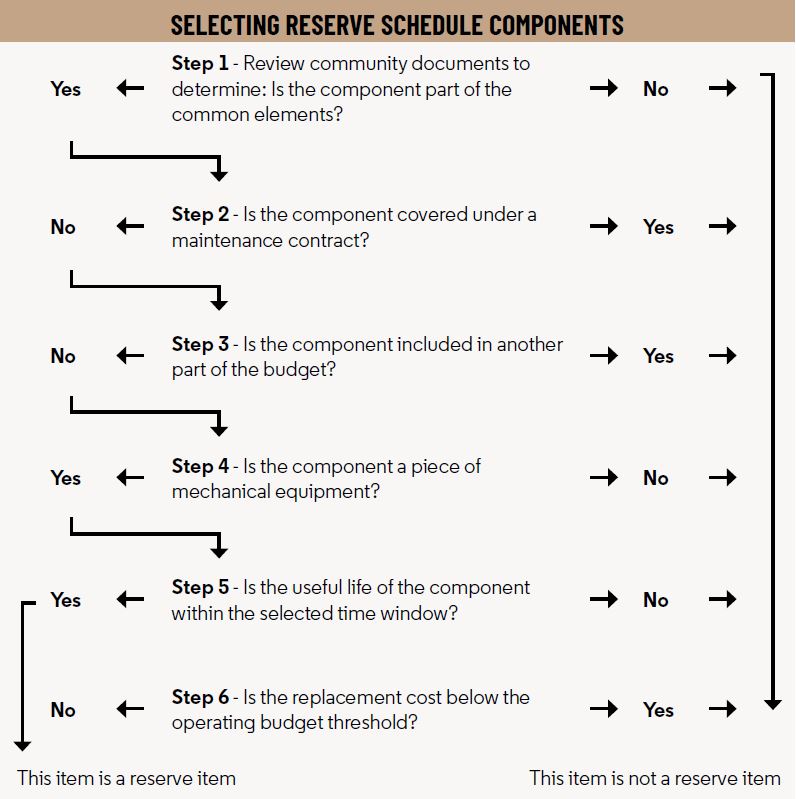

Determining a reserve schedule

A reserve schedule is the financial summary of the reserve study. Its format depends on thefunding method used, but its development will usually follow the steps detailed in the figure below.

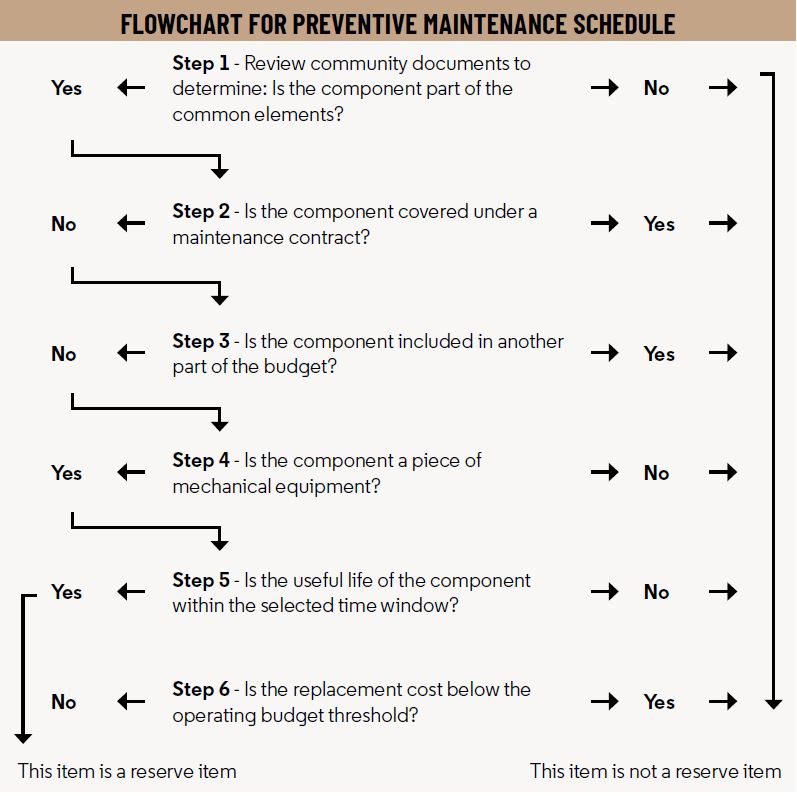

Establishing a preventive maintenance schedule

Preventive maintenance is done for two primary reasons:

• If associations do not maintain the components on the reserve schedule, they will not attain their full useful life. Consequently, the components will need to be replaced earlier and the replacement cost will need to be collected over a shorter period of time. This could result in special levies being imposed.

• If associations do not maintain the components that are not included in the reserve schedule, they may require replacement, whereas if they were maintained, they would not.

The flowchart below describes a preventive maintenance schedule.

Selecting a funding plan

Once your association has established its funding goals, the association can select an appropriate funding plan. You should consult a professional for help in choosing between the three basic strategies:

• The full funding strategy is to attain and maintain the reserves at or near 100%.

• Baseline funding involves keeping the reserve cash balance above zero. This means that while each individual component may not be fully funded, the reserve balance does not drop below zero during the projected period.

• Threshold funding is based on the baseline funding concept, but the minimum reserve cash balance is set at a predetermined rand amount.

Developing an investment policy

Developing a policy for investing reserve funds allows boards to make consistent choices, and brings structure and continuity to investment decisions.