Advertisement

Good news for property buyers, but even better news for property developers and sellers. The affordability ceiling for first-time buyers who qualify for a FLISP subsidy has been increased from the previous average home loan amount of R 680,000.00 to R 870,000.

This is a significant increase of R 190,000, which may change the property industry for first-time buyers and property sellers. This means that sellers may have an abundance of buyers for their properties in a market that is currently under strain. More people can afford to buy their own homes, and can get out of a never-ending cycle of renting.

Further good news is that properties priced under R1 million are exempt from transfer duty.

How and why this happened

There are two reasons for this price jump – the interest rate adjustment, and the fact that the banks are competing for business.

The recent 1% drop in the prime lending rate means that, on an income of R18,000 per month, a home buyer can qualify for R41,750 more property finance with the new prime interest rate of 8.75% compared to the previous 9.75% interest rate.

The Banks are competing for business and coming to the ‘party’, so they are adjusting the RTI or Repayment to Income ratio.

‘I was blown over recently to learn that two of the financial institutions active in the home loan market were able to bend over backwards to improve their RTI criteria, and increased their usual income ratio of 30% to 35%,’ ”, says Meyer de Waal, who assists home buyers with FLISP and home loan applications. ‘This was for a home loan applicant with a very good credit score and sufficient affordability,’ he added.

Advertisement

De Waal explains how this works: ‘We received a FLISP application for a home loan of R800,000 already approved by a Bank. The first check is to establish the gross income of the applicant. The maximum income for a FLISP application is R 22,000. Based on past experience, the maximum home loan a buyer with an income of R22,000 would obtain would be a home loan of +/- R 680,000.’

So the R800,000 approval raised alarm bells.

‘I immediately contacted our home loan originator, Chantelle Wallace, to question the income of the buyer as it would be fruitless to submit a FLISP application if the buyer earns more than R 22,000 per month,’ Says Meyer.’ She told me this home loan for R800,000 was approved for a client who earns R19,700 per month. I asked her: “How did this happen? Did the bank make a mistake?”’

An exceptional case

Chantelle explained that financial institutions are looking for exceptional clients:

‘At the moment,’ she explained, ‘I am aware that two home loan lenders are prepared to bend over backwards for clients who have a good credit score and can demonstrate sufficient surplus, or in banking terms, “repayment to income value”.’

Sufficient surplus, or repayment to income ratio, means that the home loan applicant does not have too much debt to service every month, and will have a sufficient surplus left of his or her salary after paying the new home loan, living expenses and debt repayment.

In this instance, the bank was willing to extend the usual 30% ratio of repayment, and offered a 35 % RTI.

This increase meant that the home buyer was granted a higher home loan amount , which this increased his buying power.

Not every home buyer will qualify for this exceptional home loan offer, and we urge home buyers to educate themselves a bit more about how to prepare and groom yourself for a home loan application, before you take the big step to buy a property and apply for a home loan.

Consumers are still trapped in debt

Although financial institutions are keen to approve home loans, some 56% of home loans are still declined. The average South African citizen spends almost 66% of his or her income to service debt.

Paul Slot of Octogen explains: ‘We have taken hands with mortgage origination companies to assist their clients who were unsuccessful to raise a home loan to lend a helping hand to improve the budget management and, as such improve affordability and credit profiles for future home buyers.

‘We also structured a budget fitness programme for clients who sign up for a rent to buy home ownership programme. The Rent2buy programme is available in the price range R400,000 – R1,8 million. Many FLISP first time buyers will also qualify for a Rent2buy purchase opportunity.

‘We assist the rent to buy clients to stay budget-fit, and increase their affordability and improve their chances to qualify for a home loan approval at the end of a two-year rent to buy cycle.’

Even better news for first time buyers

The even better news for first-time buyers is that they can qualify for a FLISP Government subsidy.

To qualify for this subsidy, a home buyer must:

- be a South African citizen

- earn between R3,501 and R22,000 (gross combined household income)

- be a first-time buyer with a dependent spouse or a child

- have an approved home loan

- never have been the benefit of a housing subsidy before.

For example, a home buyer with an income of R19,700 per month ought to qualify for a FLISP subsidy of R 39,409. To calculate a FLISP subsidy – click here on the FLISP Subsidy Calculator.

How to apply the subsidy

The FLISP subsidy can be used to:

- improve your buying power (if you R39,408 to an R800,000 home loan, you can buy a property for R 839,408

- pay your transfer and bond costs – (in the Western Cape only) you can use the FLISP subsidy to pay transfer and bond costs – on an R800,000 home transfer costs will be R21,500, and bond costs R20,300. (Use this handy transfer and bond costs calculator)

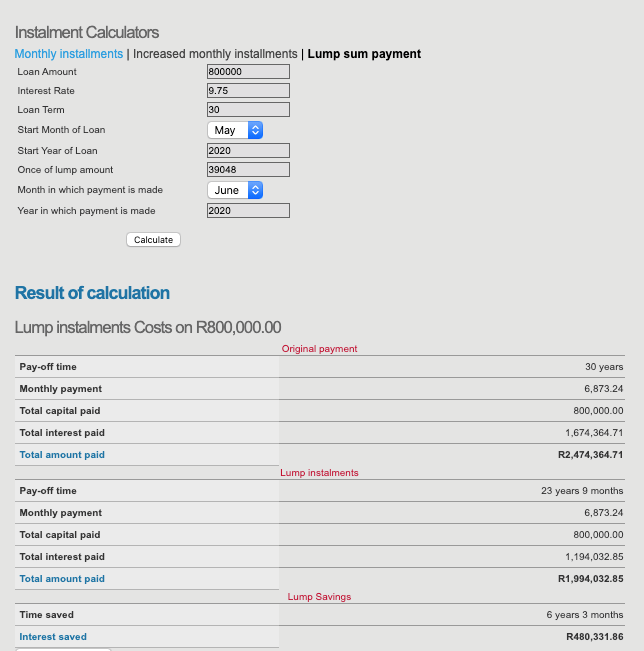

- reduce your home loan amount and save thousands over your home loan repayment term. If you pay back R 39,048 into the bond as a once-off payment, you will save R480,331 over a 30-year term. This is close to 50% of the home loan and can shave six years and three months off the repayment period.

‘We urge clients to pay back the home loan faster,’ says De Waal. ‘This can be calculated as follows:’

Now is the time to buy your own property

What shape are you in for the best home loan deal? Do your own fitness test to see if you are ready to qualify for the best home loan rate. Go to FLISP Credit Score Check to determine if you are ready to qualify for the best home loan deal. Complete your credit score online, and also do your online affordability calculation.

‘The recent reduction of 1% in the interest rate, as well as the aggressive competition between the financial institutions created the ideal time for a first-time buyer to get his or her foot on the property ladder,’ says De Waal.

For more information, contact: Meyer de Waal Telephone:021 461 0065 Email: meyer@mdwinc.co.za FLISP https://www.flisp.co.za/