Advertisement

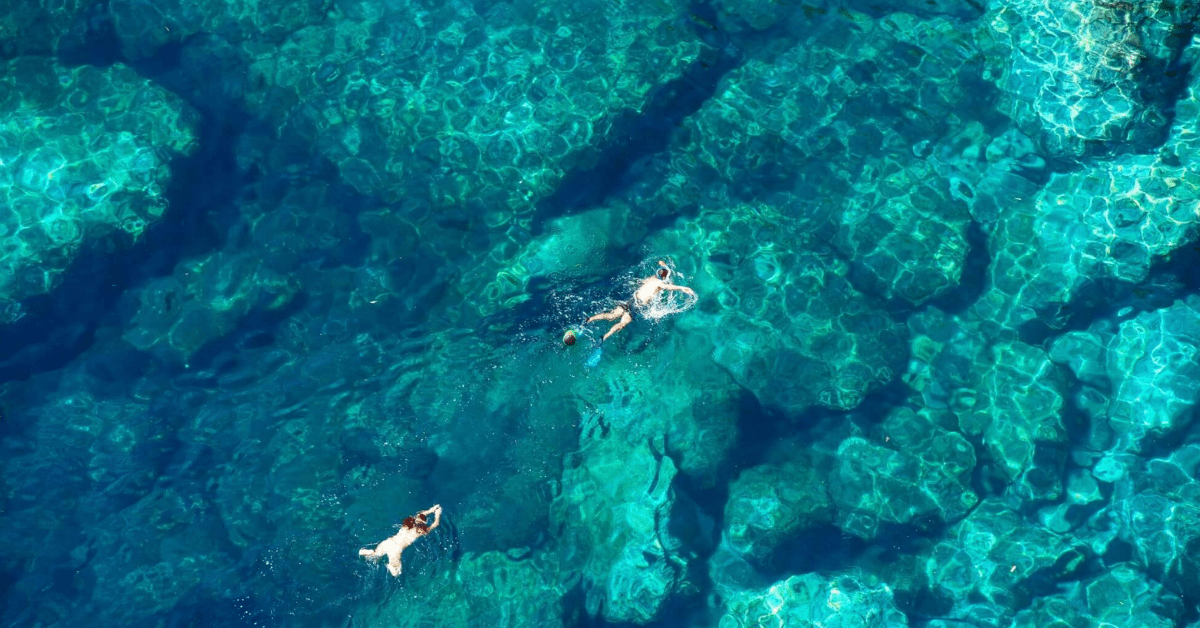

Everybody knows that good business has to be sustainable,and that – really – we do not have to choose between a profitable economy on the onehand, and clean air and oceans on the other. So, cleverly, the Republic of Seychelles has put the two together and launched the world’s first sovereign blue bond — a pioneering financial instrument designed to support sustainable marine and fisheries projects. And, of course, to preserve the clean oceans and clear air of these beautiful islands.

The bond, which has so far raised US$15 million from international investors, demonstrates the potential for countries to harness capital markets for financing the sustainable use of marine resources. The World Bank assisted in developing the blue bond, and in reaching out to the three investors: Calvert Impact Capital, Nuveen, and Prudential Financial, Inc.

Proceeds from the bond will include support for the expansion of marine protected areas, improved governance of priority fisheries, and the development of the Seychelles’ blue economy.

Grants and loans will be provided through the Blue Grants Fund and Blue Investment Fund, managed respectively by (SeyCCAT) Seychelles Conservation and the Climate Adaptation Trust (SeyCCAT) and the Development Bank of Seychelles (DBS).

Advertisement

Seychelles is an archipelagic nation consisting of 115 granite and coral islands. It has a land area of 455 square kilometres spread across an exclusive economic zone of approximately 1.4 million square kilometres. As one of the world’s biodiversity hotspots, Seychelles is balancing the need to both develop economically and to protect its natural resources and environmental integrity.

Marine resources are critical to the country’s economic growth. After tourism, the fisheries sector is the country’s most important industry, contributing significantly to annual GDP and employing 17% of the population. Fish products make up around 95% of the total value of domestic exports.

Announcing the bond at the Our Ocean Conference in Bali on 29 October, the vice president of the Republic of Seychelles, Vincent Meriton, said: ‘We are honoured to be the first nation to pioneer such a novel financing instrument. The blue bond, which is part of an initiative that combines public and private investment to mobilise resources for empowering local communities and businesses, will greatly assist Seychelles in achieving a transition to sustainable fisheries and safeguarding our oceans while we sustainably develop our blue economy.’

Will the blue bond protect Seychelles from proposed military base?

Reflecting concerns felt by many Seychellois about a proposed military base to be developed in conjunction with India, consultant and ex tourism minister of Seychelles, Alain St Ange, said: ‘Today a feel-good factor has surfaced and Seychelles needs to live up to the declarations it makes. Seychelles must walk the talk. The big question that arises is whether sustainable oceans and the protection of marine areas are able to go hand in hand with a military base with a foreign power. The UNESCO World Heritage Site of Aldabra, for example, is but some 20 miles from the proposed military base of Assumption Island. Recent reports show that baby dugongs (sea cows) are now back in that lagoon. Now nuclear submarines may be parading alongside them as warships pass overhead.’