Advertisement

Many South Africans are investing in property in the UK, and if you can afford to do so, now is a great time! Whether it be due to family or business circumstances, future plans or simply the desire to diversify, there are some exciting opportunities to look at.

In July we saw the rand strengthening against the pound, converting to pounds sterling at the current exchange rate of around R17.40 to a pound. When you factor in a stable growing UK property market, a guaranteed rental for the first 2–3 years as well as low interest rates (compared to South Africa), you’ll see that it really makes sense.

Take, for example, the property market in Manchester, which is predicted to increase by over 22% between 2018 and 2022. And holding property in London for any period of five years or more in the last two decades would have put you into profit, even taking into account the Global Financial Crisis.

Doing the sums

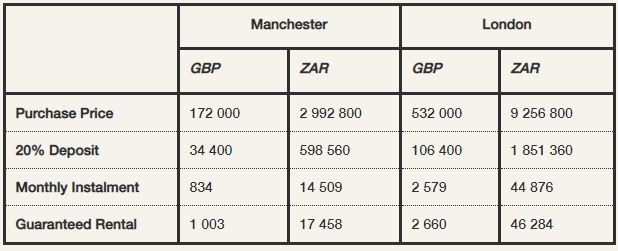

Investment properties in Manchester can be found for around ₤163,000 to ₤181,000 and in London for around ₤483,000 to ₤580,000. Using a middle-of-the-range property in each city, you will see that the monthly cash flow works out far more favourably than similar investments back home.

Advertisement

Assumptions

The monthly instalment is calculated at a 4% annual interest rate over a 20-year bond.

Guaranteed Rental for Manchester is calculated at 7% of the property value per year and for London at 6%.

An investment property in Manchester is not far off from the local prices we’re used to, but the low interest rate in the UK and the guaranteed rental make this a compelling offer with a positive cash flow from the start.

Do note though that this simple calculation does not take into account upfront costs involved in the purchasing process, nor monthly expenses or other costs such as taxes.

More about the guaranteed rental

Finding tenants and managing the monthly rental payments can add a little stress to the investment process. Even though most investors hand this over to a service provider, it’s safe to assume a one-month vacancy per year when doing initial calculations. However, with a guaranteed rental you can be absolutely certain of the minimal rental amount per month and you can better predict your cash flow.

A specialist property investment company, is currently offering a guaranteed rental for the first two years on selected properties in Manchester, while the guarantee extends to three years for some of the developments in London.

Interested?

Look out for straightforward access to overseas real estate, from initial research and acquisition through to management and exit strategies, a provider that assists throughout the entire investment process. Locally placed experts are able to advise on the property market and create an investment proposition that’s tailored to your needs.

An investment property in the UK may well be within your reach.