Advertisement

We have recently taken our newly launched Section 12J property fund to the investment market. I’m a property specialist, with a bit of an asset management background, so the 12J structure really appealed to me when it first caught my interest. What I’m finding is that many people we are chatting to about the tax incentive really don’t fully understand its structure and workings. If it sounds too good to be true, it probably is, right? Wrong!

The glaring misconception is that 12J merely delays tax and investors get ‘nailed in the end’ with Capital Gains Tax (CGT), but this is not the case at all.

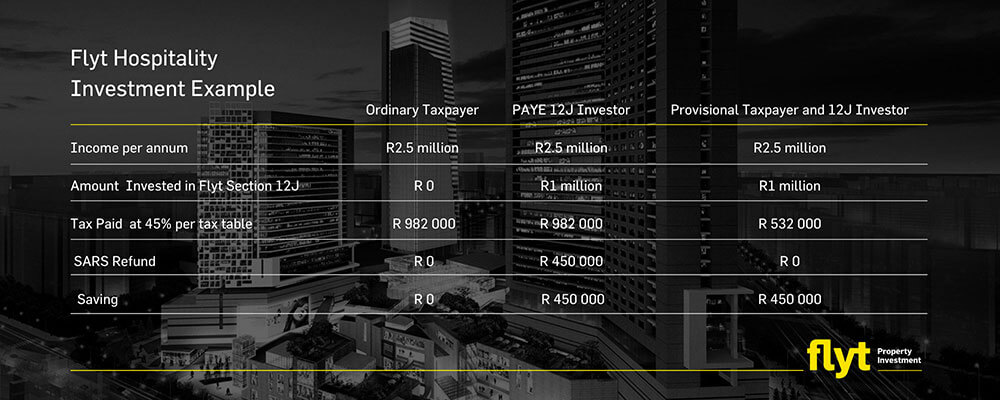

Based on an annual income of R2.5m, let’s break it down as an example.

Patricia earns R2.5 million per year and therefore falls in the 45% tax bracket; according to the tax table, R982 000 is the total tax due by her to SARS. Let’s say she invests R1million into a Section 12J fund. This R1m is treated as an ‘expense’ or tax-deduction, so her next tax return would look very different.

R2.5m income earned, less the R1million deduction, leaves Patricia with a balance of R1.5million taxable income, equating to a tax obligation of R532 000 and a tax saving of R450 000! Better yet, if she is a salary earner and pays PAYE, then her employer would have already paid the full R982 000 to SARS and in this case she would be due a refund from SARS of R450 000, thanks to her investment in a Section 12J fund. For self-employed individuals or companies who are subject to provisional tax, the R1million invested means they avoid paying the R450 000 and only need to pay tax of R532 000, as opposed to R982 000.

Advertisement

Okay, so that’s all good and well and any smart investor would grab this incentive in a heartbeat, but the confusion comes about when an investor is looking to cash in.

An investment into the The Flyt Hospitality fund is locked for 5 years, so let’s say (without considering any return on the invested amount) Patricia sells her shares in the fund after 5 years for the same value (R1million). Yes, that R1million is subject to Capital Gains Tax which is calculated at 40% of the gain. So 40% of R1million is R400 000 and Patricia would be required to pay her 45% tax due to SARS of R180 000.

The bottom line?

Of her R1 million Patricia pays R180 000 tax five years down the line, rather than R450 000 upfront. The number cruncher in me calculates that as a R270 000 saving and a 60% reduction on her tax bill.

What is also important to remember is that not only have you reduced your tax burden, but you have delayed it too, by a minimum of five years. If you opt to stay in the investment fund after the five-year period (you don’t HAVE to sell), you have avoided paying that tax until such time as you do sell. In the meantime you enjoy the full benefits (capital growth and dividends) of the full investment amount. If you don’t sell your shares in the fund, you never pay the tax. Investors in the Flyt Hospitality fund who opt to stay in the fund, retain their investments at full value and receive dividends for as long as they remain invested in the fund.

I would even go as far as to break the Section 12J investment into three major opportunities:

- 12J converts income tax into capital gains tax (resulting in a 60% reduction of tax)

- 12J delays this reduced tax obligation by at least 5 years (during which time you enjoy the benefits of having the full amount invested for your account)

- You can stay as long as you want! Remaining in the fund means you keep your investment, you don’t pay the CGT and you earn dividends based on the gross (pre-tax) amount

Need any more convincing?

About Flyt Hospitality

Property has always been an attractive investment to add to a portfolio. Anuva Investments has partnered with Flyt Property Investments, a Cape-based property development company, to offer a property diversification via Flyt Hospitality, a Section 12J fund dedicated to finding exceptional opportunities in the property sector.

All investments are underpinned by Flyt’s prime property developments/real estate, and investors have the option of an attractive exit after 5 years or to continue earning passive income for as long as they like.

Our strategy is simple; find outstanding opportunities in the property sector, good quality, strategically located hospitality properties with a focus on sectional-title serviced apartments. Our developments come with a complete management solution and an experienced operator in place.

Minimum investment: R1Million

Tax deduction: 100% of the invested amount

Period: Minimum 5 years

Benchmark ROI: 11% pa compounded

Distributions: Zero during the first 5 years

Quarterly after the 5-year period

Geared: Yes, up to 40% loan via Investec Private Bank

Website: https://www.flytproperty.co.za/

Facebook: https://www.facebook.com/flytpropertyinvestment/

Instagram: Flyt Property Investment

LinkedIn:

About Flyt Property Investment

Flyt Property Investment is a Cape-based property development and investment team committed to finding opportunities that challenge the status quo. We work in the public domain on spaces that have the potential to change things. We never shy away from complex problems and believe in finding the solutions from within, unlocking opportunities through innovation, taking a different angle, thinking intelligently and laterally.

Flyt buy, develop and add value to property through joint venture and independent projects. We maximise return by completing rigorous project evaluations upfront, by co-investing in work we believe in, and by closely managing our business. We currently have 5 projects actively on the go and our pipeline is a very exciting one. We’ve stuck to our recipe of creating wealth for our shareholders, all the while contributing positively to the built environment and progressive landscape of the Cape.

Website: https://www.flytproperty.co.za/

Facebook: https://www.facebook.com/flytpropertyinvestment/

Instagram: Flyt Property Investment

LinkedIn:

About Anuva Investments

Anuva Investments is an FSB-regulated and FAIS Act-compliant Venture Capital Company, formed in 2014 by a combined team of tax and investment specialists. Anuva invests in small and medium-sized companies where the opportunity exists to significantly enhance profitability through a management involvement process. Higher risk investments are balanced by investments into well-established businesses with proven profitability and stable cash flows.

The positive cash flows that result from a well-structured VCC investment are matchless. The investor can potentially receive a full tax deduction on the funds invested as well as substantial dividends from his investment on an ongoing basis.

Website: https://anuvainvestments.co.za