Advertisement

Technology has become an integral part of our lives and it is the main driver of change in the insurance industry. That is why as Santam, we have embraced the benefits of integrating the Internet of Things (IoT) into existing insurance models and systems.

Luckily, the prevalence of the IoT has benefits for almost every facet of life… including prospective geyser troubles. Geyser-related issues are the most common household insurance claims we receive and they can cause a great deal of anxiety for homeowners and tenants alike. It’s not just replacing the equipment that’s expensive. It’s all the damage it can wreak when it bursts. Think where your geyser is right now. Imagine the devastation should a cascade of water come down – cupboards, flooring, electronics, and general flooding, especially when you’re not at home.

Santam Specialist Real Estate, in partnership with Sensor Networks, launched the integration of the IoT into existing insurance models and systems – including smart-geyser devices; forming part of our focus on smart-home insurance solutions. This innovation providers us the ability to reduce risk and build claims-prediction models based on streaming data received by the IoT sensors.

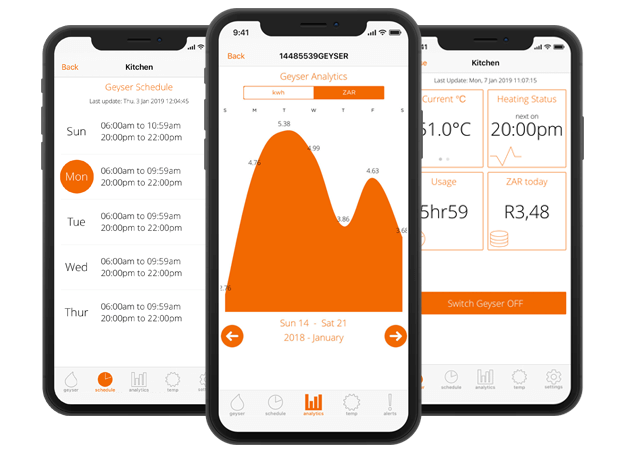

What do these smart geysers do? Head of Santam Specialist Real Estate Karl Bishop says, “This kind of innovation is essential as most geysers only have an expected life span of around seven. It is safe to assume that most homeowners or tenants will suffer geyser related issues at some point. A Sensor Networks smart-geyser device is retroactively fitted to the homeowner’s electric geyser and linked to their smartphone via an App. In the event of a leak, burst geyser or blown element, the device recognises the problem and automatically shuts off the water and electricity supplies to the geyser.

Advertisement

We believe that interventions such as leak detectors on geyser units can identify problems with a unit long before they escalate to the point of bursting. This means that as insurers, we can replace geysers before they lead to massive resulting damages in the form of electrical, structural, and other damage to the home contents. By removing the need to claim through better risk management, one reduces the disruption to an individual’s life.”

Bishop says using Sensor Networks’ bespoke IoT hardware and software platforms, homeowners are afforded an added layer of control. They are able to manage their geyser temperature and heating schedule, which are arguably the main contributors to household energy usage.

“Often we want to save energy by reducing geyser usage but we either forget or just don’t get around to it. This technology makes it super-simple, which makes us more likely to activate it!”

He adds that Santam also receives an immediate notification when a geyser issue occurs, leading to the speedy processing and resolution of any resulting claims. “This technology allows us, as the insurer, to either pre-empt or react proactively to potential incidents, rather than acting on a reactive basis. Homeowners and/or tenants will benefit by either having a potential incident completely averted or the effects of the resulting damage being significantly reduced.”

Managing agents are key in helping homeowners to proactively manage their risk by encouraging them to install the Sensor Network in their homes/units. The added benefit is that this technology will enable homeowners to reduce the need to claim, thus saving on insurance premiums and reduce their energy bills. Adversely, if insurance premiums and energy bills decrease as a result of better risk management, homeowners have more disposable income in their pockets.

Insuring with Santam means that you are protected by South Africa’s leading insurer. Santam helps you find your way through life’s ups and downs by providing insurance solutions based on over 100 years of experience. Our promise of insurance good and proper means we take the time to understand the risks you face and consider the solutions best suited to your needs. For more information visit www.santam.co.za

Santam is an authorised financial services provider (licence number 3416)