Advertisement

Lock-up-and-go investment properties have become more and more popular as investors realise the benefits of low maintenance, security and easy placing of tenants.

It’s true that one pays a monthly levy to the body corporate and that, as an individual owner, you may not have as much say over matters but, as an investor, it’s often easier – especially if your property is in a different city, province or even country.

It’s obviously worth your while to do your homework on how well the body corporate is operating, but generally speaking you can see that from your first impression of the building. It’s really useful to pay a fixed monthly amount that covers all your major maintenance, and owning a unit without a garden relieves you of one more responsibility. You can deal with minor tasks such as interior painting, or a burst geyser, but the main building maintenance is managed by someone else.

Welcome to Cape Town

Sing along if you know the song.

Advertisement

Everyone loves Cape Town and, over the last few years, with online booking companies like Airbnb making it so easy to manage short-term rentals, the market has been booming and many people have invested specifically to cater for the tourist market.

There’s been an increased demand for short-term holiday rentals and apartments in the busy tourist areas such as the Waterfront, Foreshore, Sea Point and Green Point, so these have become prime locations for investors.

With shops, restaurants, attractions and public transport, these areas offer city living with the added advantage of the ocean and Promenade just a stone’s throw away. You really do have the best of everything.

A cautionary tale

Interestingly though, things are changing and the latest Cape Town sub-regional house price data from FNB shows that price growth turned negative in the City Bowl, Southern Suburbs and Eastern Suburbs (such as Salt River and Woodstock), along with the Atlantic Seaboard, in the first quarter of 2019. Owners have also been feeling the pinch a bit with rentals, as they’re not able to simply apply the double-digit increases they could a year or two ago.

There’s also been an over-saturation of the Airbnb market, forcing many investors to lower their nightly rates, which is impacting on initial calculations. Also concerning (for property investors) is the potential impact of the newly published Tourism Amendment Bill. This bill stipulates that short-term home rentals will fall under the Tourism Act, which empowers the tourism minister to lay down ‘thresholds’ for Airbnb in South Africa. This could include limits on how many nights guests are allowed to stay over, or how much income an Airbnb host may earn, and even a determination of zones in which Airbnbs are allowed.

This won’t just affect Cape Town. Any neighbourhoods that currently cater for the Airbnb market could potentially take a knock. Think of the number of business people using short-term rentals in areas such as Sandton and Rosebank. This could change significantly going forward.

An investment case – how do things compare?

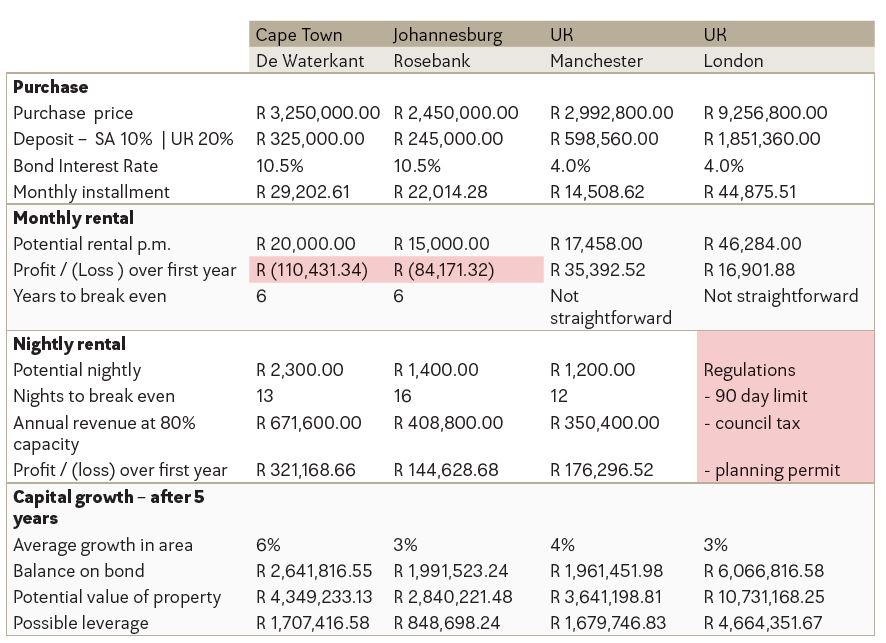

Looking at similar new developments in Cape Town and Joburg it seems that you’ll definitely get more bang for your buck in Joburg, but this does depend on where exactly you’re looking. Despite the current price data figures and the concerns around short-term rentals, Cape Town properties are still priced high and are being snapped up quickly. A newly built single-bedroom unit in De Waterkant will set you back over R3 million, while a similar apartment in Rosebank (Johannesburg) is around the R2.5 million mark. The difference becomes even more apparent as you look at larger apartments – a three-bedroom apartment in Sandton costs between R3 million and R5 million, while a similar-sized apartment on the Cape Town Foreshore would go for anything between R9 million and R15 million.

Property growth overall in the Western Cape, according to Lightstone Property, is still the highest at an average of 5.4% per year compared to Gauteng at 2.3%. But it’s hard to justify investing more than double to simply gain an additional 3.1% growth. The better growth does clearly mean a better investment, but it’s a matter of affordability, and whether you are willing to place such a high amount into a single property.

The rental market is not that much better in Cape Town (in the specific areas mentioned previously), so you should do some solid research.

Taking it abroad

Investing in property abroad is not as complex as you may think. There are a host of specialist companies that can assist in all aspects of investing abroad – from the initial research and acquisition through to management and even exit strategies.

Regarding Airbnb and similar short-term rental services, the city of London has already implemented regulations that limit the number of nights to 90, along with an additional council tax. Manchester has not yet implemented any regulations but, as we see locally, change is imminent.

Assumptions for all calculations:

- 10% deposit is paid along with a home loan over 20 years.

- No taxes, rates, levies or other fees have been taken into account.

While sifting through many listings, one gets a sense of a realistic monthly or nightly rental, but it’s important to remember that there is quite a variance depending on exact location, the state of the unit and the building. For short-term stays, the interior and finishes play an important role too.

One should err on the side of caution when doing calculations and try to factor in all the costs that are known.

The calculations

The table below compares similar developments in different cities along with some key factors. Note that the exchange rate used for the UK investments is R17.40 to the Pound.

Thinking it through

Besides the facts and figures, an important factor to consider is whether you are purchasing a place that you plan to live in yourself later in life. Finding a suitable retirement apartment has many added advantages and having a foot in the door in the UK may be useful in the future. Similarly, retiring in Cape Town may be appealing to you or perhaps you wish to be nearer your family in Joburg.

There are many elements to consider, so consulting with a specialist is always recommended – especially for some of the trickier aspects such as taxation and estate planning.

South African living and working currently in Switzerland. From CT initially, southern suburbs and looking for an investment to rent out and use when in SA.