Advertisement

Some governments in other parts of the world have gone to some extraordinary lengths to tackle affordability of housing in their respective countries.

Take Japan for instance. Their lending agreements allow house purchasers to apply for 100-year home loans, which typically results in the debt being passed onto their children. It’s effectively leasing a property from a lender for life (and those of your relatives).

The United Kingdom (UK), meanwhile, is considering the introduction of 50 year mortgages, inspired perhaps by the Japanese model. Could this work in South Africa? And, more importantly, would this be a solution for the country?

Cross generation mortgages – the benefits

Advertisement

In a world where interest rates and house prices are going up every year, politicians are considering possibilities of extending mortgage terms to allow people to access home ownership more easily.

Under the plans considered by the British government the longer-term products would enable people to borrow larger amounts from lenders and if they were to die during the loan term the debt could be passed on to their children. How this would work in practice though is still unclear.

Longer term mortgages are already growing in popularity. The Guardian highlighted that Building Societies Association stats show that 37% of first-time buyers are opting for mortgages of between 30 and 35 years in the UK.

They’ve also soared in popularity as those in full time pay see their salaries not keeping up with inflation. The advantage of extending the term on such loans is the ability to keep repayments low – something that’s still possible in a low interest rate environment.

It may also make it far cheaper to buy as opposed to renting, but this would depend on the market concerned.

A good idea?

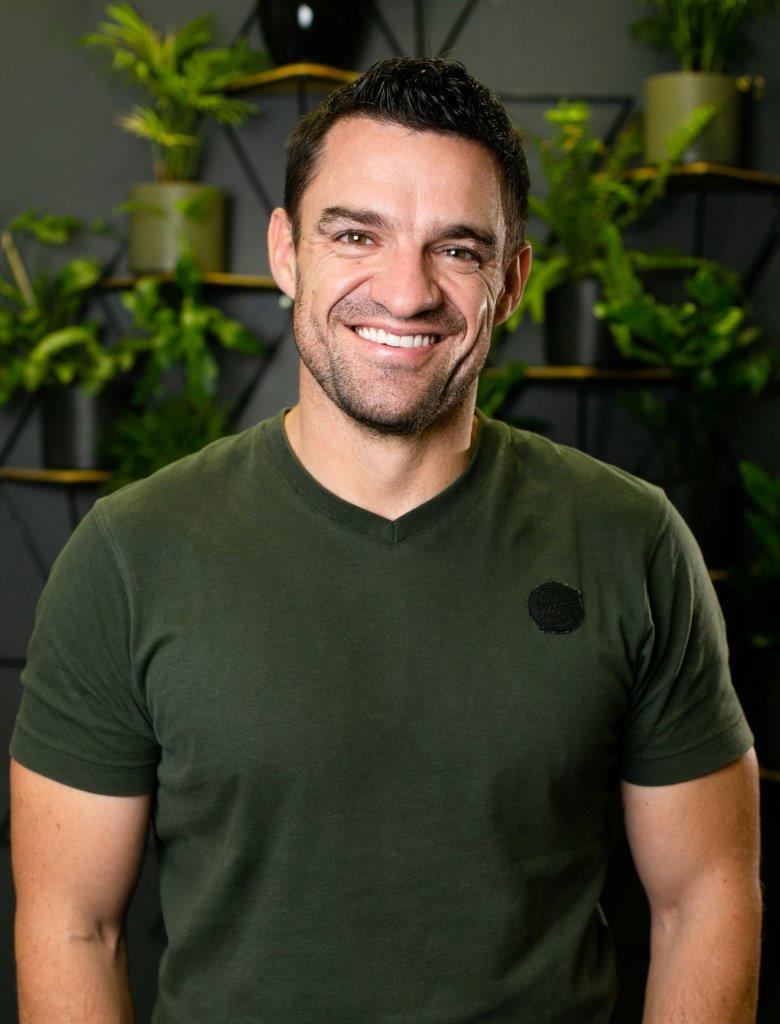

So, is a mortgage term that’s longer than 25/30 years ever a good idea? Grant Smee, managing director for Only Realty and CEO of Frankie Bells says: ‘Depending on your current situation, it may not be a bad idea to opt for a longer bond period if it’s made available to you. When one factors in the cost of living, rising inflation, the price of levies and municipal rates then a higher bond term could offer some breathing room and flexibility.

‘In a case like this however, I would strongly advise that you continue to save the additional money that you would have put into your bond each month and reinvest it to make a return. Remember: a longer mortgage term means that you will incur more interest over time. As your income grows, it’s also advised that you pay down the bond period by putting in extra money each month.’

Passing on debt to children

If a longer-term mortgage was made available, the same scenario could play out like it has in Japan where debt is passed onto children. But would this work? A property could after all still be an ‘inheritance’ even if there is debt tied to it.

But experts highlight that this problem could be mitigated by appropriate life cover. ‘The customer may opt for credit life insurance, which covers the outstanding balance on the home loan in the event of death, disability, loss of income and retrenchment. Or general life cover, which can be used to settle the home loan debt in the event of the customer passing on,’ points out Mfundo Mabaso, growth head of FNB Home Finance.

The bigger question is: will we ever see such a product introduced in South Africa? According to FNB, one of the biggest lenders in the country, it’s unlikely. Currently, FNB offers home loans with terms of up to 30 years.

Mabaso says: ‘We offer terms up to 30 years – with a strong drive for customers to pay in more than their minimum repayment, affordability permitting.’

He adds: ‘It is unlikely that we would offer a term beyond 30 years given the prevailing interest rates. The intent of providing mortgage lending is to help customers build wealth, and at a term longer than 30 years there opposite may be true.’