Advertisement

The first step on your journey to home ownership is understanding your credit profile, so that you can improve your credit score to get the best possible loan terms for your new home.

The importance of a good credit profile

As you may be aware, a higher credit score will, in many cases, result in banks and other home loan companies offering you a lower interest rate on your loan. This could mean that you can afford a larger house, or have more cash for those new home ownership expenses. In addition, calculations show that if you are offered an interest rate of 2% above a typical lending rate, your repayment over 20 years can cost you an extra 32%. That is why we advise that, when applying for finance, you always approach the financier armed with an application that includes a credit report with a good score. Do you know what your credit score is, which factors have an impact on your credit score and, perhaps most importantly, how to improve your credit rating?

Your credit score is calculated by credit bureaus that collect and assess account information received from your creditors, and also look at your financial behaviour. There are five factors credit bureaus use when calculating your score:

- Factor 1 – 35% of your credit score depends on your payment history. A good track record of regular on-time payments will improve your credit score. Missing payments or only making payments 30 days after the due date will lower your score. Here they are looking for a history of good behaviour in terms of making payments.

- Factor 2 – 30% of your score depends on your outstanding debt percentage. Let’s use an example in which a borrower has different loans and credit facilities, and where the original outstanding loan balances totalled R10,000. After a few years, the borrower has managed to bring the outstanding balances down to R3,500 or 35% of the original R10,000 loan amount. Lowering your outstanding debt percentage by a large amount will improve your credit score. Failing to do so may decrease your credit score, which means a higher interest rate and/or qualifying for a smaller bond.

- Factor 3 – 15% of your credit score depends on the age of your credit accounts. The longer the period you have had credit, the better your score will be.

- Factor 4 – 10% of your credit score depends on how many new loans, or enquiries for new loans, you are making over a certain period. If, let’s say, over a few months you take out quite a few loans and/or regularly enquire about obtaining loans, your credit score will decrease. This is because, to credit bureaus, it looks as if you are constantly shopping around for credit applications, and are relying on debt to survive.

- Factor 5 – The last 10% depends on the types of loans you have. Typically home loans or vehicle loans will have a better impact on your credit score than say credit card debt, or short-term revolving loans.

Improving your credit score

Advertisement

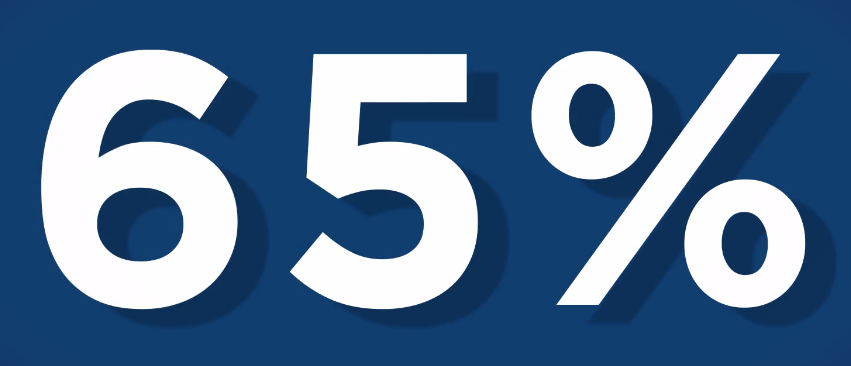

Remember, 65% of your score is influenced by just two factors, namely payment history and outstanding debt percentage. So it’s clear that the two most effective strategies for obtaining a good credit score are to:

- pay your accounts regularly, and on time

- have a disciplined approach to bringing down your existing loan balances as quickly as possible.

It’s as simple as that. But here’s the catch – you need to do this without taking out new debt. The most effective way to achieve this is to put debit orders in place and ensure that your payments go off in good time.

You may view your free credit profile by linking to our service provider’s My Bond Fitness programme and getting an indication of your credit profile status. Easy-to-read dashboard screens will assist you in understanding your credit score.